It seems like over the last few years, there have been almost weekly announcements of new routes from one of the ME3, the three major middle east airlines (Qatar, Emirates, and Etihad), to the United States. As of now, these three airlines fly, or have announced, routes from the middle east to the thirteen U.S. cities.

As a Denver-based flyer, I have heard a lot of talk about whether we can expect to see some exciting new liveries at Denver International Airport in the near future. I keep finding myself going back and forth between thinking, “yes, we’ll hear an announcement any day now” and “nope, it’s never going to happen.”

Warning: lots of analysis and numbers below. If you want the short version, skip down to the bottom. Otherwise, settle in and let’s look at some numbers.

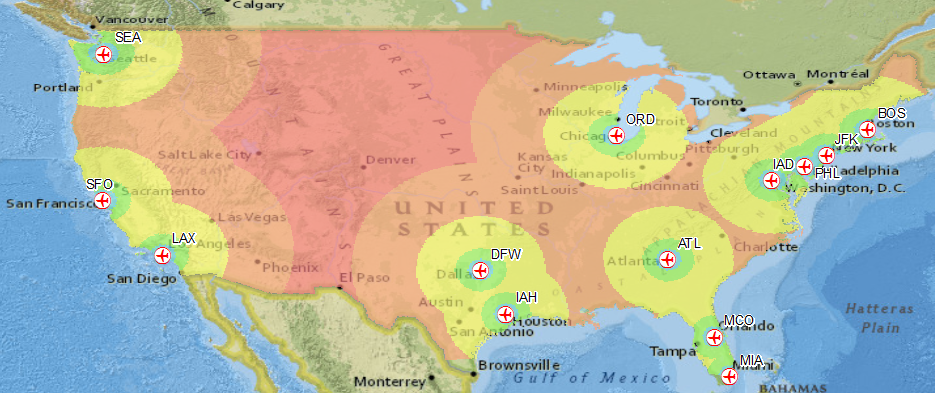

As an engineer, I decided to do what I do best – start analyzing things and putting some numbers on paper. The first thing I did was chart the geographic reach of the ME3 within the United States. That resulted in the map above. The green areas are within 100 miles of an ME3-serviced airport, the yellow areas are 100-to-250 miles out, orange areas are 250-to-500 miles out, and the red areas are more than 500 miles away from any ME3-serviced airport.

Combining this information with the 2010 U.S. Census data gives us some interesting numbers. Of the U.S. population in the lower 48 states, approximately 44% live within 100 miles of an ME3-serviced airport, 64% live within 200 miles, and 95% live within 500 miles.

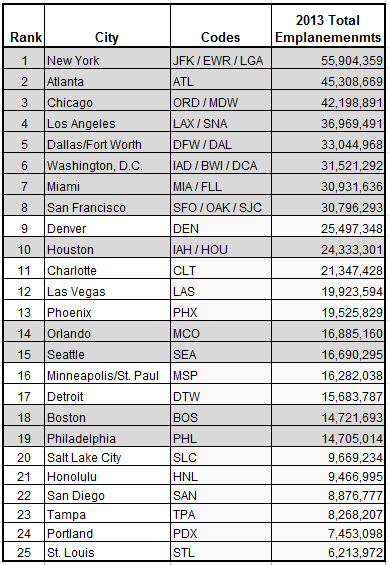

The next piece of information I dug up was a list of airports, ranked by their total passenger count. I combined markets with multiple major airports (e.g. JFK, EWR, and LGA for New York). In this list, the markets already served by the ME3 are highlighted in grey. Again, my hometown of Denver is looking pretty ripe for a new route.

The above list doesn’t tell the whole story, however. As a hub to United and Frontier, and a major transit point for Southwest, Denver International Airport has a lot of connecting passenger traffic. And while the total passengers going through the airport is a major draw for any carrier, a lot of the appeal of flying an ME3 carrier is one-stop travel to far reaching destinations in Asia and beyond. This kind of traffic relies on an airport’s capacity as an Origin and Destination (O&D) facility.

The following list ranks U.S. markets based on domestic origin and destination; that is, if each market had one airport, and all flights were nonstop, these would be the biggest airports.

Again, the markets already served by an ME3 airline are greyed out, with Las Vegas now in the lead for a new route and Denver in the number two spot. Like the total emplanement numbers, these figures can be skewed by airports that overperform within their region – i.e. passengers who have a choice between two airports choose the airport that has the airlines and the departures to meet their needs. To determine which markets would be likely to draw passengers, we can take a look at population and demographics.

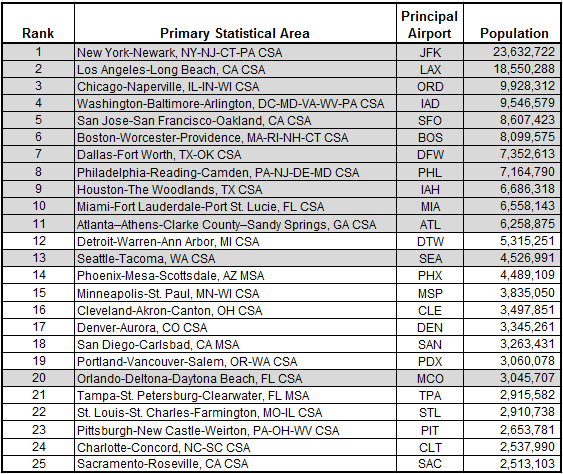

The following lists the top 25 Primary Statistical Areas of the United States.

As with the other tables, the markets already served by an ME3 carrier are shown in grey. Comparing this table to the above tables illustrates a different story – really part of a bigger demographic story of the United States as a whole. Now, the top unserved market is Detroit, followed by Phoenix, and Minneapolis/St Paul (MSP). My favorite airport, Denver, falls to #5 on the list.

Too many numbers? Okay, here’s a plane to break them up.

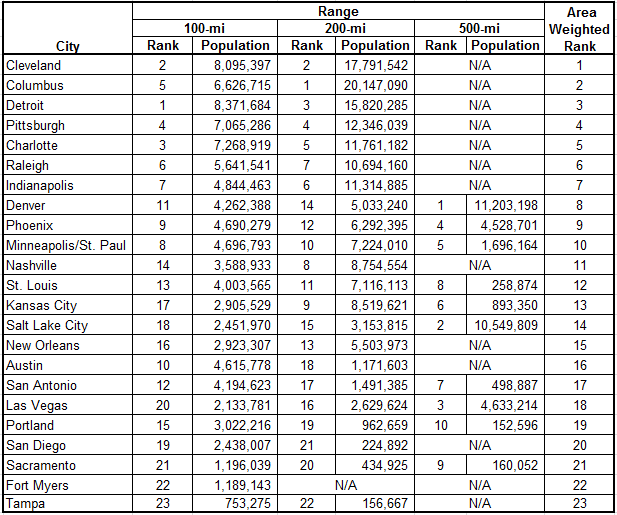

Let’s continue, shall we? Combining the Census data with GIS geoprocessing allows us to go into some greater detail about the populations surrounding each candidate airport. The first thing I looked at is the total population within various ranges of the airport that is not already served by another ME3 airport within the same range. That is, how many people live within, for example, 100 miles of each airport that do not live within 100 miles of an airport already serviced by and ME3 carrier. I did this math at the 100-, 200-, and 500- mile ranges, then ranked the cities based on inverse distance weighting the population.

Major population centers unserved by an ME3 airline – Source: 2010 U.S. Census

Interesting – even more so than the statistical area lists, this list favors some of the bigger rust belt cities with large surrounding populations (Cleveland, Columbus, Detroit, and Pittsburgh). Denver is now down to number eight on the list.

It should go without saying that the primary reason that the rust belt region is so underserved is that most of these cities have economies without a heavy international focus. Despite large populations, cities with weaker economies are not as likely to generate the business revenue needed to support a route, especially one serviced by the high premium seat density aircraft favored by the ME3 carriers. Another important piece to the puzzle is cargo, which is also driven by business.

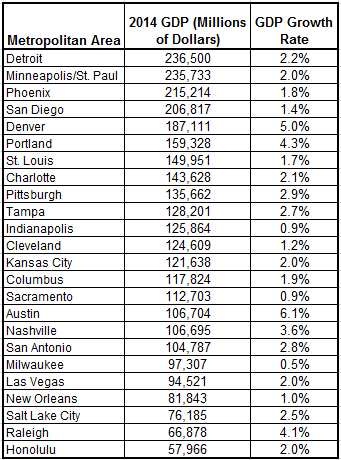

Perhaps the best measure of a city’s economic health is its GDP and GDP growth. The U.S. Department of Commerce publishes an annual list of metropolitan area GDPs. Trimming this list to cities unserved by the ME3, we get the following list:

U.S. metropolitan area GDPs and GDP growth rates – Source: U.S. Dept. of Commerce Bureau of Economic Analysis

Yay, my hometown made it back into the top five (and we’re number two for economy growth)!

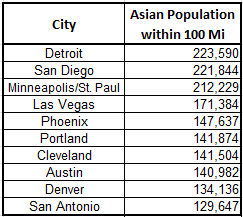

One final statistic that I think is an important consideration is ethnic demographics. A significant portion of the ME3’s passenger load is visiting friends and relatives (VFR). Much of this traffic, from the United States at least, is to Asian countries. Although VFR passengers are more likely to drive up passenger counts in the economy cabins as opposed to the more profitable premium seats, they are definitely a piece to the larger puzzle. The following list ranks the top 10 candidate airports by Asian population within 100-miles, based on the 2010 census.

Asian population within 100 miles of principal airport – Source: 2010 U.S. Census

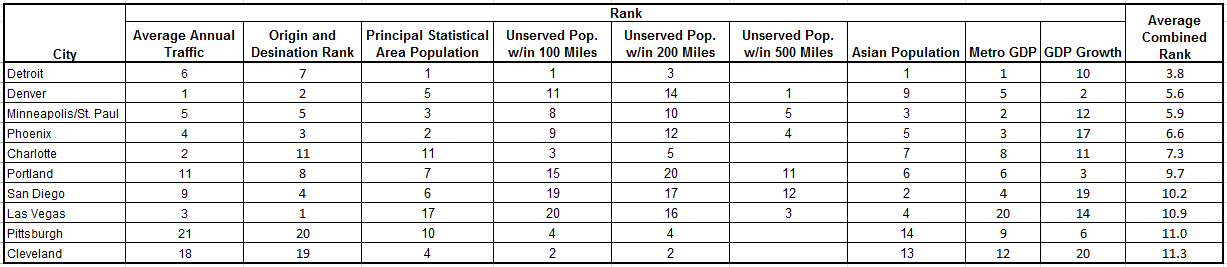

So pulling all the statistics together, I developed an overall ranking of cities based on the above criteria. I present the top 10:

We’ll review each of these cities in depth in a moment, but first, let’s briefly consider the equipment that might be used to service a new route. As these markets all represent the smaller U.S. markets, it is unlikely that any of these cities would demand the capacity of an A380, which is operated by all three airlines. Even a 777-300ER would be a stretch, as the capacity doesn’t seem justified. The nonstop distances are significant, ranging from 7000 to 8500 miles; this somewhat limits the equipment that could be used on such a route. These long-haul distances to smaller markets do seem perfect candidates for both the 787 and A350. Qatar and Etihad collectively have 100 787s and 105 A350s in operation or on order.

Qatar Airways’ first A350 (MSN006) at the Airbus Delivery Center ’“ Photo: Bernie Leighton | AirlineReporter

Emirates is a bit of a different story, however. As the airline’s business model revolves around larger widebodies, Emirates does not have any orders for either the 787 or the A350 (although they had an A350 order that they cancelled a while back). Many of these routes could potentially be operated by Emirates’ 777-200ERs, though it would likely take the range of a 777-200LR to operate the longer routes. Emirates collectively owns 16 of these aircraft and has been actively pulling them off some routes (DFW, LAX, SEA, ORD), replacing them with larger A380s and 777-300ERs. In addition, Emirates currently has 150 Boeing 777X jets on order that could be used to service such routes after their entry into service – currently scheduled for 2020.

City-by-City Rundown of ME3 Service Potential

Detroit, MI (DTW). My Odds – 3:4

I’m surprised that none of the middle east carriers are flying to Detroit yet, although Royal Jordanian does fly there. It seems like a no-brainer. It’s true that the economy of Detroit has been in bad shape in recent years, and DTW isn’t exactly a thriving airport, but I can’t believe that the seat of U.S. automaking doesn’t have direct service to the middle east. When I was in India a few years ago, I was surprised how common the Ford brand is – U.S. automakers are doing big business there. The Detroit area also has a huge Muslim population. In addition, Detroit’s economy is in the midst of a modest recovery. Finally, Detroit is driving distance to many of the rust belt cities further down on this list. Of all the criteria I considered, Detroit checks all of the boxes. I’d put better-than-even odds that DTW sees a new route in the next year or so.

Minneapolis / Saint Paul, MN (MSP). My Odds – 1:2

Although Denver edged out Minneapolis in my list, I think MSP airport probably has a slightly higher likelihood of getting an ME3 route. Its large, diverse population and strong GDP makes MSP seem just ripe for the picking. I’d put even odds that we see service into MSP in the near future. Look out Delta – your hubs are my two highest candidate cities.

Denver, CO (DEN). My Odds – 1:3

I’m obviously (not) impartial here, but I think Denver has a good shot at getting a new route. With a diverse oil and tech-driven economy, one of the busiest airports in the country, lots of tourism-fueled Origin and Destination traffic, and no competing major international airports within nearly 1000 miles, I believe a new route would perform well.

Phoenix, AZ (PHX). My Odds – 1:4

Phoenix ranks as the third biggest economy, and second largest population center unserved by the ME3. Although it doesn’t have the booming economy or busy airport that Denver does, I believe it would be a viable option for an ME3 carrier.

Charlotte, NC (CLT). My Odds – 1:8

Although a smaller market in and of itself, Charlotte has lots regional traffic which drives a busy airport. With the region’s fast-growing economy, I could see some interest from the ME3. I’d be really surprised, however, if that happened before one of the cities higher up on this list.

Cleveland, OH (CLE). My Odds – 1:8

Does Cleveland rock? It ranked at the very top for cities with a large unserved ME3 population. While CLE airport itself isn’t exactly a booming place these days, its strategic location within the underserved rust belt region might just warrant a new route. Detroit’s only a few hours down the road however, and I expect it would have much higher appeal to a middle east carrier than Cleveland. If for some reason, political or otherwise, Detroit does not get a new ME3 route, CLE would jump much higher on this list.

Las Vegas, NV (LAS). My Odds – 1:10

The reason that Las Vegas ended up so high on the list is its gaming and tourism industry, which drives high Origin and Destination passenger numbers. Does the draw of high stakes gaming and high-end hospitality warrant a new route from the Middle East? I would be surprised if it did, but it is worth noting that Las Vegas has a number of successful international routes from Europe, Central America, and even a Korean Air flight from Seoul.

Portland, OR (PDX). My Odds – 1:15

Portland is a relatively small market, but has a strong GDP with solid growth and lots of Origin and Destination traffic. However, Seattle – and its twice-daily Emirates service – is only a few hours up the road. I doubt PDX will see much interest from the ME3, but you never know.

San Diego, CA (SAN). My Odds – 1:20

San Diego is tough. Although it ranked higher up in my overall analysis, there are some serious factors working against it. It’s only a few hours down the road from LAX and its A380-heavy service. At around 8,500 mi, it’s also the most far-flung of any US destination, out-ranging most of the smaller aircraft that might be practical to service such a route. Pulling off a route into San Diego would be tough without a fifth freedom right to do so.

Pittsburgh, Pa (PIT). My Odds – 1:20

There was a lot of discussion earlier this year about Pittsburgh potentially getting a Qatar Airways route. Although I don’t really see the demand for it, considering the other candidates on this list, it does sit within a few hundred miles of a huge population that does not otherwise have access to an ME3 route. I’d put it as a distant third contender for a rust belt route behind Detroit and Cleveland. Stranger things have happened.

Conclusion

When examining number of orders on the books by all three Middle Eastern airlines, it’s clear they all have their eye on expansion. I expect, in time, many of the above cities will have direct service into Doha, Dubai, or Abu Dhabi.

Although this analysis covers many of the economic and demographic factors behind new route selection, there’s a big piece missing – politics. International, national, local, codeshare, and union politics all play a big role in where an airline chooses to fly. It takes backing at all levels to make a route work – without broad-based support, a new route will never get off the ground. I think the rust belt region is definitely next in line for a new route, but politics could decide whether it goes to Detroit, Cleveland, or Pittsburgh.

Comments are closed here.

Your methods are exactly what I was taught in University, oddly! In the airline business, we did the same thing. I completely agree with your conjectures and numbers. I need to add a few things, however. Regarding San Diego, it is not just the fact that LAX is just up a multitude of highways – it has complex approaches/departures and a very short runway. Even with a fifth-freedom, the smaller widebodies of the ME3 fleet will need a lot of careful weight and balance planning to get any further than the equivalent distances of London or Tokyo (neither of which would be in countries prone for a fifth freedom expansion). I’m too lazy to bust out the performance data I have on hand to verify this, but even with today’s powerful twins I cannot see anywhere with a strong O&D market in San Diego beyond a major European hub that in and of itself is not a purely O&D based destination that would make San Diego viable as such.

Regarding Detroit, it depends on what you are after in the market. I would love to see the cargo numbers out of Detroit. While there is a large Arab, Persian, and South-Asian population in the Wayne county and Dearborne area- are they doing business within the ME3’s core markets? VFR traffic does not a long-haul make! Now, if you could bring in a compellingly small (two-class) aircraft and sustain the route with cargo volume. It could be very appealing. With the air freight prices being so low, however, I think it’s a great idea to leave Royal Jordanian to their long-established niche with a tiny 787-8.

MSP would be great, except it’s a Delta hub and the airport depends on Delta. Letting an ME3 airline into there would cause a ton of friction. I am not sure the airport authority would do it without a metric ton of cash in miscellaneous fees to smooth over any hurt feelings. I mean, if I were EK or QR I’d still do it. Double daily to start with. But most people don’t like to play scorch the Earth as much as I do.

Denver is the best bet of your choices by O&D if you ask me. Affluent population, growing international business ties, lack of international service for a population of that size, etc. On top of that, even with the high altitude of the airport- it has massive runways. A once a day 77W from EK or a 77L from QR would match the demand, have great yields, and maybe have some decent cargo potential.

I am not sure if the other cities are on the radar beyond “begging for service”. That just has to do with things my millions of tiny birds have told me.

– Bernie out

Hi Bernie, do you think that there could be any Canadian expansion in the near future? Currently Etihad and Emirates serve Toronto but that’s it. I wonder if Montreal could be a candidate, it’s far enough from Toronto and Boston and it is an important business city.

My other thought regarding Detroit, is that the US automakers – more so than other industries – are likely to fly only US-based airlines. They have powerful unions to answer to and are perhaps the biggest proponent of the “Buy American” philosophy. I could see a strong political backlash if their executive started flying ME3 airlines.

Yeah, except Chrysler is owned by an Italian company 🙂

Can’t be done. Canada hates competition and economic freedom. Check out how EK and EY have to share six frequencies a week.

Never going to happen. Must protect Lufthansa at all costs!

Yeah, I forgot how much of a silly country we are on these fronts. It’s a shame as I would love to see more international options out of Montreal, which is the closest major gateway to where I live in Ottawa but alas Air Canada is afraid of competition.

There are so many worse economic cartels and fears in Canada that by the time your country gets to airlines, it will probably be 2050. From the Beer Store to the Supply Management system- a large segment of Canada is deathly afraid of anything that may create anything resembling a free market. Price floors for all, competition for none!

Look at how confused the scientist are at 3:10 why do they seem so lost? Because with all their learning and study the still realize that they are empty souls and they don’t know why. They are to to have a dialogue within. False, They will remain lost and blind until they have a dialogue with The Lord of Glory and come to the realization that their lives are meaningless without a relationship with the one who gave them their mind and intellect and SOUL to begin with. We are body, mind AND spiritVA:F [1.9.13_1145]please wait…VA:F [1.9.13_1145](from 0 votes)

Seems to make an argument for ME# going to DTW–market it heavily in Toronto!

Emirates will never go somewhere just to serve a Canadian city near by. It would be like the jokes about how Emirates would consider serving regional cities in Poland and bus people there from Germany. In fact, precisely no one will market an inconvenient U.S. dollar denominated ticket in a period of Canadian economic collapse. If DTW is to be served, it will have to be on its own merit.

Bernie: Vancouverite here.

Emirates runs ads in the Vancouver Sun advertising fares to the Gulf, with the words “Connecting thru Seattle operated by Alaska Airlines”, so they at least have the desire to serve this market.

Undoubtedly, if/once Ottawa frees restrictions nonstops would come to YVR, but as you hinted at, that’s a whole another complicated ball of very red tape.

Detroit isn’t exactly close to Toronto, it’s a good 6 hour drive away so not sure how much impact that would have. As Bernie mentioned, flying to Detroit would need to be based solely on Michigan’s merits and nothing to do with Toronto (which Emirates already serves)

I’m getting used to the fact that I will likely never have a svelte body again….but am not happy with how I do look. Sticking to motivation for me is the hardest when there are other people around to go out to dinner with, or vacations or special holidays….There always seems to be something to drive away my motivation…It’s a struggle…Diane

same also for YVR and SEA

Excellent, thoughtful analysis. After looking at your map I paused to consider which cities I thought were best suited for ME3 growth. Totally a “gut feel” approach based on limited knowledge about each venue. I decided that DTW would be a solid candidate given a large, and growing middle-eastern population and rebound of that economy. I threw MSP in simply because it’d upset DL’s Anderson, going after him at one of his pristine, and mostly unchallenged hubs.

Pretty stoked my guesses aligned with your findings although I will confess I much prefer your analysis.

More of this sort of stuff please, DaveDLG!

I would, in all honesty, also expect a wave of expansion to come after an increase in frequency into core markets. This is why PDX is out for the next few years. Eventually, someone will talk some sense into KSEA and get a Code-F gate. Even if they don’t, the enhanced codeshare between EK and AS means that the PDX market has a 40 minute flight (and lower ticket price because of the connection) North to get to anywhere in the World. I know the World does not revolve around EK (it revolves around EY), but EY is short on aircraft, as seems QR- so those two are highly unlikely to reach for an outlier.

Unless you are a huge metro area with an affluent population, like Denver, it makes more sense for the ME3 to keep expanding frequencies to match the demand and use a local partner to move the self loading freight to the connecting point. If the yields are shockingly high, then you probe.

If it wasn’t a 14 hour flight, I’d say shotgun it- a widebody with good cargo and strong VFR demand on a four hour flight… That’s gold! That’s how the ME3 started to conquer India. Can’t do that here. Get someone else to take the domestic risk unless it’s a sure thing. Three planes per route for a daily is a lot of money.

I like the approach and data but there are two factors you de-emphasis which are important – connecting passengers and airport incentives. On the first, Jetblue has a code share with Emirates which now has two flights a day – far more that the gateway city justifies. In addition, Qatar is part of One World – which could drive more traffic at Charlotte – for example. In contrast, Denver is dominated by United and Southwest – both of which don’t have a logical collaboration with the ME3. On my second point, airport will quite often subsidize a new route to get a new airline to fly in. I am sure the ME3 (as does Turkish) to open new routes.

Overall, I do like your logic and argument build.

I agree – I tried to capture the connecting traffic a bit by looking at the airport use numbers, but what is more important, as you point out, is who is flying the numbers. For the ME3, it’s JetBlue, Alaska, and American that are the important players. But given that those hubs are pretty much all already served, aside from additional frequency of service to existing hubs, I really think future expansion will really focus on new O&D markets.

As far as airport subsidies go, that’s the politics angle I was getting at. That’s why it’s hard to completly discount any airport on this list, and even some that didn’t make it. I could see Pittsburgh, or Las Vegas or someone like that luring a new ME3 route with some good old fashioned economic incentives and tax breaks. Kinda makes you stop and chuckle at the not-so-subtle irony of a US governmental organization subsidizing an ME3 route, huh?

have you thought about drive time instead of pure distance?

Although I have access to the geospatial tools that can do that kind of network analysis, it is much more difficult to perform. I can see how certain parts of the country with slower and less direct roads may have different ‘effective distances’ to core airports, but I doubt it would have a significant impact on the overall results.

I would also add that it may not be so much geospatial awareness in a case like this, but there’s also a lot of consumer psychology in play to determine whether or not a drive is “too far.”

When discussing how far a drive is too far, there are so many variables in play from the price of gas to the price of parking, to the perceived value of the experience. You can do a sweep of America and say “okay, this infrastructure could be improved”- but an airport is only an economic engine because of its links to the community, not the fact that someone from two counties over can now drive there more easily when they are already served by an, effective, regional airport a ten minute drive from their home/office.

That’s the problem with this business- everything is a factor!

Denver has long coveted service from Turkish, given the natural Star Alliance benefits of the United hub.

Legitimate question about Denver: in worst-case conditions there, can a fully loaded 77W/A380 take off? I know that it has very long runways, but given that Denver to the Middle East would definitely be ULH, it would be a challenge. As far as I can tell the furthest airport served from Denver right now is Narita, and it would be a significant stretch to serve Dubai/Abu Dhabi/Doha.

77W may have to take a weight restriction on the absolute hottest of days, but that would likely be relating more to tire-speed limitations if I recall correctly.

Oddly, and this should be hyped more, the A380 is a hot and high/short-field royal. It’d crush the route.

At 16,000-feet, Denver’s runway 34L is the longest public runway in North America – it was built with this kind of aircraft in mind. While I’d be surprised if any airline saw the demand to fly an A380 out of Denver, the airport could handle it.

Delta does JNB-ATL nonstop. That’s 700nm more than DEN-DXB and taking off from 100 feet higher than DEN! Guarantee that 99 and 5 nines percent of the year a 77W wont encounter a tire-speed issue!

That’s awesome! I had no idea JNB was that high.

Delta’s ATL-JNB route is handled by the 77L, a frame with a significantly better thrust-to-weight ratio, along with a much longer range. Recently, an EK 77W doing DXB-SEA, after only one landing attempt, diverted to Vancouver, declared MAYDAY, and landed with ~25 mins of fuel remaining. That’s right, into their 30 min final reserves. There’s no way a 77W will be able to handle a Middle East-Denver route without blocking off half the seats.

I could see Emirates doing it. Of course, sometimes they seem to follow a “because we can!” strategy when it comes to A380 deployment…

I would be shocked if a gulf airline served MSP. We have one Asian route served daily by Delta and several other Delta routes to London, Amsterdam and Paris (with Air France sending a seasonal A340). Delta has made noise about opening routes to inland China with the A350 but there’s no talk in the aviation or business communities about the need to reach the Middle East. Fwow, our airport cannot handle the A380 anyway.

I’d guess (knowing nothing about the marketing involved) that Detroit would be more attractive than MSP, just give the high middle-eastern population. Would it draw customers from Toronto? Wouldn’t imagine LasVegas would be as big a draw as the traffic numbers suggest–I’d imagine there’s better vacation/gambling cities closer to the ME3’s core than Vegas, as I’m guessing the gaming is driving much of the non-connecting traffic in and out of there.

An amusing report that includes some interesting data. What does it really mean? Sorry, but not much. We already know that Etihad’s Great Big Airplane can reach their home hub from anywhere in the U.S. or Canada that can accommodate the airplane, if they wish. This is not new news. At this point, I think it is more about available seats (In and Out) and airport capacity, than it is about the airplane itself. For example, I’m not sure that SEA currently hosts ANY A380 operations. Infrastructure aside, does SEA have enough traffic aimed at the Gulf hubs to justify a 550+ butt airplane, daily or even thrice weekly? I don’t think so. Maybe you have better data. Facts remain that those Super Jumbos CAN make the reach from the U.S., but do they need that much reach? Again, IMO, with four burning, they are almost never route-limited; continuing on three is not a major handicap and of course, there is No Two- engine ETOPS Range restriction. This is about market and market share, not a given airport’s ability to land, taxi GATE, service, board and reverse those huge airplanes. Some airports can accommodate most needs, but few can manage all needs. The Super Jumbos may have the range, but a lot of airports simply do not want them. Think it through… -C.

Hey Cook,

The challenge, coming from the middle east, is the heat — which means load factors can be reduced. But the newer planes are opening up many new route opportunities.

Probably not a huge surprise, but I keep checking in with SEA to see about A380 options. As of now, they can handle an emergency landing, although most of the airport would need to shut down. It would be possible to get the airport A380 ready, but obviously that would take time and money.

Right now Emirates operates two 777s. The 777-300ER holds 427 passengers and the 777-200LR holds 266, which is a total of 693 [now, I am not 100% sure which versions they fly, so that is rough numbers].

Their A380 has 429 seats (new-ish no first has 615). All that said, what are the load factors? I heard different things at different times.

Does frequency make more sense with an airport that is not able to handle the A380? Probably. But personally, of course I want to see Seattle get its first A380 :)!

David | AirlineReporter

At least 85% DPB. I’ve spoken to my little birds in the middle-east, they assure me that the lack of 388s gracing our terrible airport is mostly due to political pressure due to a certain Chicago-based company. Or, well, perceived pressure. No one actually cares if an A380 flies to Seattle – it is not a shot across the bow, it is not against local pride. But, as I have said a million times anything to do with transport in William Rufus King County is run by monkeys bashing keyboards. Instead of modifying the international terminals to meet demand, they built a third runway that can’t be used simultaneously. The truth is that regardless of what the local rabble think- Seattle is a growing market that already can sustain an A380. EK would probably prefer not running a third 77W into SEA… and don’t get me started on the cargo myth.

The 427-pax 777-300ERs are 2-class. The 3-class A380s carry 489/491 or 517/519 pax, depending on whether they have crew rest areas. The 3-class 77Ws with crew rest areas have a capacity of 354. Also, EK only has a fairly small number of 2-class planes. I don’t know about the 77Ws, but none of the 2-class A380s will have crew rest areas, so will be limited to ~10 hour flights.

Cook –

I’d agree that the market for A380 service is pretty limited, and there is likely not a whole lot of need for additional A380 service to new markets in the US. However, despite the leading photo, this story is not about the A380. This is about the 787, A350, and, to a lesser degree, the smaller 777 variants. These small, long range, highly efficient aircraft are changing the world and opening up new routes that would never have been possible before. When you have a plane that seats 250 people, but has a 9000+ mile range, it’s pretty remarkable what you can do.

Granted DTW has lots of VFR, I dont think there is enough demand to suffice for its own indvidual route. I believe AA and B6 is currently funneling the DTW traffic for both QR and EK via PHL (QR) and BOS (EK and soon QR as well). With that being said its best to have an assset light approach in an uneasy market.

If anything the ME3 will be adding frequency instead of additional capacity to other gateways within the United States. Expect to see QR playing catchup with EK within the next couple of years with the addition of SFO and SEA.

With all the commentary above about YYZ having EK and EY flights, no one mentioned that QR in fact flies DOH-YUL 3x weekly with a 777-300ER. They have for years. So each of the ME3 operate into major Canadian hubs. That said, if there was an open skies agreement between Canada and the GCC countries, or at least more capacity allowed under a bi/multilateral agreement, I’m sure EK could move to daily or more A380 service ex YYZ just for starters. EY too, I bet, as well as QR adding at least a DOH-YYZ frequency. I can also imagine additional ME3 lift into YVR, YYC and possibly even YOW – if they had rights. It will be interesting to see how AC’s new YYZ-DBX service works out for them, given limited beyond lift within Star Alliance ex DBX and what I have to believe are not a lot of DBX destined pax. If they don’t make a go of it and pull out, it’s hard to imagine the Feds pushing back on additional EK frequencies.

Stuart: much hinges on Ottawa getting its head out of its a** and AC quittin’ their bitchin’. The ME3’s only option into the rest of Canada might just be a business agreement with Westjet……