Let’s get something out of the way. I am not a United fan. In fact, I have said numerous times that all things equal, I’d rather fly Spirit. Why do I bring this up? Because after using United’s MileagePlus X App for a year, I’m starting to come around. And that, my friends, is a pretty big deal. Opinions formed from years of disappointment and failures at all levels don’t change overnight. They certainly don’t change as the result of side-project ancillary revenue apps. But here I am, about to tell you why you should be a MileagePlus X user too.

The United MileagePlus X concept is simple: Use the app to buy gift cards for everyday purchases at thousands of retailers and get United miles as a kickback. Earnings per dollar spent at merchants vary widely, typically between one and five miles. Earnings are dependent upon on the merchant and the time of year. For example, the standard for Amazon seems to be one mile per dollar, but I have seen up to three. The norm for Gap/Old Navy/Banana Republic is five, but for a while during back-to-school season earnings jumped to ten miles per dollar.

This arrangement is win/win/win. United gets a slice of the transaction (yay ancillary revenue!), the retailer gets a sale they may have otherwise lost, and the consumer gets miles. The concept United is using is far from the typical dining or shopping programs offered by nearly every other airline. When I think of the words “innovative” and “pioneer” United does not come to mind. But both apply in the context of MileagePlus X.

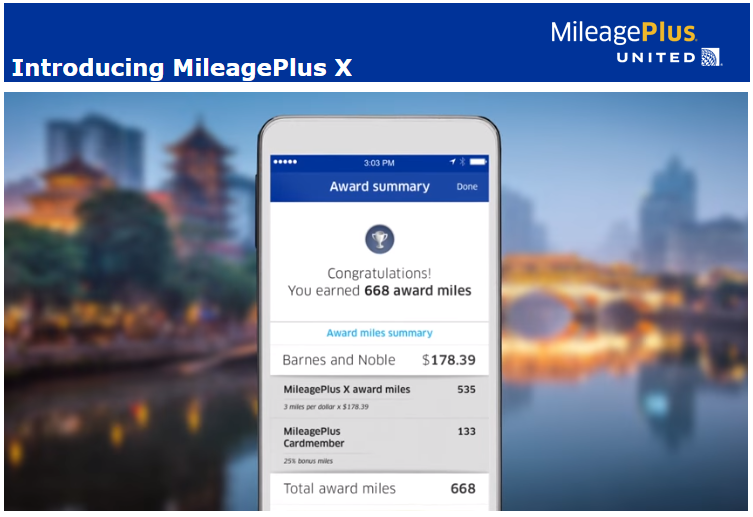

What little marketing United has done: Earn miles for every dollar spent at participating stores and restaurants with MileagePlus X – Image: United

MileagePlus X Overview:

United launched their MileagePlus X service in late 2014 to a decidedly muted and skeptic audience. The airline’s untouched marketing page for the service still sports the original (severely outdated) YouTube intro video from that December, nearly two years ago. Thankfully, the application development team has not rested on their laurels. Updates to the application and the supported retailers are often published, suggesting what might have started as a side project has grown into a bonafide cash positive revenue stream.

MileagePlus X has slowly caught on. This, despite the airline’s marketing and social media efforts outright ignoring the existence of the diamond in the rough. Enter the most passionate UA fans and mile/points collectors. For a long time, the rest of us didn’t know the service existed, didn’t understand its purpose and value, or frankly, didn’t care. I will take responsibility for having been a skeptic, but only if United assumes responsibility for doing a miserable job at promoting the service.

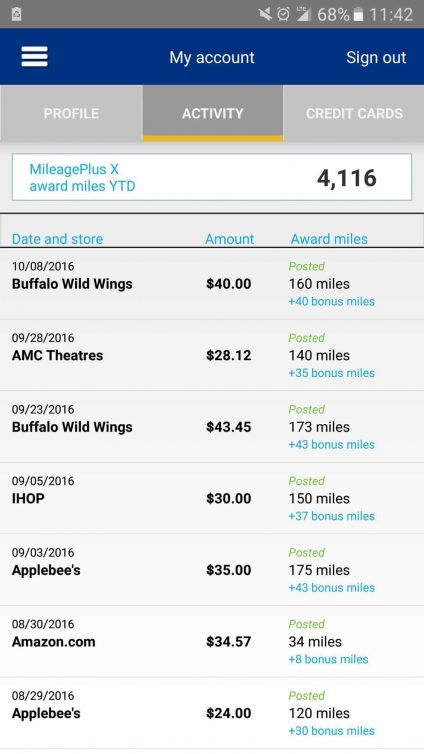

After much nagging from fellow AvGeek pals, I decided to download the app in November of 2015. At the time my MileagePlus bank sported a lowly 1,839 miles. Since downloading the app, I have flown United only once: MCI-ORD-MCI earning 806 miles. As I write this, I now have just shy of 15,000 United miles banked. Said another way, I have collected over 12,000 United miles through MileagePlus X in about one year. That’s enough for a one-way domestic “saver” economy flight. But my eyes are on something much bigger’¦

United’s Star Alliance membership means access to 27 other airlines, including Lufthansa. – Photo: JL Johnson

How does MileagePlus X work?

The app is available via the Apple and Google app stores. Authentication is just as easy hard as one would expect on the website, thanks to the airline’s recent silly obsession with pseudo “two-factor” authentication. Once logged in, the design and function are pretty simple yet vary widely between iOS and Android. There are menus to search for nearby retailers, or users can browse by category in a list titled catalog. Some additional merchants of note: AMC, Apple iTunes, Bed Bath and Beyond, Lowe’s, Papa John’s, Petco, and Sephora.

New users are prompted to add one or more credit or debit cards to their MileagePlus X account. Adding cards to the wallet allows for easy selection when it comes time to buy a gift card. I recommend adding a few of your more commonly used cards for quick access. Holders of United branded credit cards: Add your account even if you don’t intend to use it. You get bonus miles just for having it on file; more on that later.

When it comes time to pay the bill, open the app, find the merchant, enter the total and choose your payment method. 10-15 seconds later the app will generate a ready-to-use gift card and automatically deposit earned miles into your MileagePlus account. Cashiers at some merchants can scan the code directly off your phone. In other cases, you will have to read off the gift card numbers, which isn’t fun. I typically use buy ahead and pickup options with retailers who can’t scan my phone. An excellent example of this is Panera’s Rapid Pickup.

MileagePlus X is well suited for dining. When the server brings the bill, I figure out the total, jot down the gift code and offer an explanation. To my surprise, servers are tolerant of point/mile collectors. Just be sure to leave a decent tip since there is a bit of extra effort required on their end. One pain point with using MileagePlus X while dining is some merchants (looking at you, Chili’s!) are increasingly reliant on those distracting and annoying Ziosk tabletop systems. I have yet to find a Ziosk terminal that allows for manual entry of a gift card. In these cases, hail a server, explain the dilemma, and they’ll be happy to oblige.

MileagePlus X showing 25% earning bonus for having a United branded Chase card linked. – Image: Scott Kagarice

Consider yourself slick? Go for the double, triple or quadruple dip:

Everything I have discussed thus far is what the experts would call a “single dip.” Miles and points connoisseurs have devised ways to squeeze even more miles out of MileagePlus X. Here are ways to further enhance the MileagePlus X experience. For the record: I use none of these personally, I’m not an airline credit card guy, and I have not bothered to check out the shopping portals… Yet.

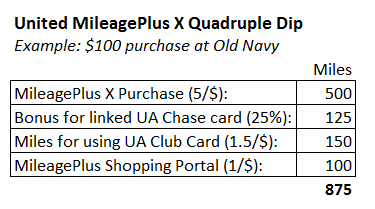

The easiest “double dip” is to have a United Airlines credit card. Adding a United Explorer or Club Card to your MileagePlus X unlocks an immediate 25% bonus on all purchases. This “link bonus” is applicable even if you use other cards for your purchases. Of course, if you have a United card, you are eligible for a “triple dip” by using the card and squeezing out an extra one or two miles per dollar, courtesy of Chase.

Another way to extend the power of MileagePlus X is to use their shopping portal. Not all MileagePlus X merchants are on the shopping portal, and not all shopping portal merchants are on MileagePlus X.

In the above example, a quadruple dipper could earn more United miles from a $100 purchase at Old Navy than I did via my MCI-ORD-MCI trip aboard a United plane. Impressive!

Thoughts on maximizing MileagePlus X with credit cards:

Note: AirlineReporter does not “push” credit cards. We receive no referral bonuses, etc.

Some credit cards treat MileagePlusX transactions as airline spend. Your experience may vary. My go-to travel card assumes MileagePlus X purchases are “airline spend” and rewards me with three loyalty points per dollar, the same level as if I had purchased an airline ticket. I read recently that Amex Platinum cardholders now receive five points per dollar on “airfare.” Again, some card issuers struggle to disambiguate spend. Thanks to this challenge, there is a fair chance that MileagePlus X purchases get incorrectly classified as airfare. Mine do!

MileagePlus X, final thoughts:

MileagePlus X is a unique, innovative and, dare I say “fun?” app with rich reward earning opportunities. In the year since I’ve started using the service, I have grown accustomed to looking for supported merchants when considering purchases. I have also noticed that my buying habits have shifted. For example, when our garbage disposal broke I was going to go to Home Depot but remembered I can score miles by shopping Lowe’s instead. United’s partners are getting additional purchases, and I feel rewarded. And because United is a part of my daily life, my opinion of them is slowly starting to improve. Well done, United!

Seeing as no one else has commented, let me be the first to give you a vote of thanks! Despite being pretty enthusiastic about getting points (don’t ask how much time I waste failing to qualify for surveys on the Opinion Miles Club) I’ve shyed away from MileagePlusX. Based on this I think I’ll download the app and give it a go.

How did it turn out for you, TCD?

I signed up for this app and the first time I went to use it the Transaction was Declined. Has nothing to do with my credit card. I called Milage Plus customer service and didn’t get anywhere. I’ve emailed them thru the app and finally got an email asking for my United #. Haven’t heard back. I referred three other friends to the app and they are all having the same problem. Any ideas? Or a phone number to call?

Thanks,

Craig

Hi, Craig. Thanks for reading and for taking the time to comment. You are not alone in this regard. Since posting this piece I have heard from others who have had similar experiences. I cannot explain how or why this is happening as to-date I seem to have been a “lucky one.” From what I have heard from experts on MPX is this is a known issue that UA is working to resolve. Email through the app is how those I have talked to have managed to find resolution, although in true United form, prepare for a non-resolution resolution.

Cheers.

JL Johnson | AirlineReporter

AirlineReporter | JL Johnson replied to your comment on United’s MileagePlus X: An App for all Flyers, Regardless of Loyalty.Thanks for getting back to me. I did email them thru the app and a few days later I got an email asking for my Mileage Plus number. A few days after that I got a reply that basically didn”t tell me anything but that I had to wait 2 weeks from the last time I tried to use the app. I guess I will try again in two weeks and if it work then I will send another complaint. Frustrating……

Great post!

I”ve been happily using MPX for about 2 years, but what I still wonder is why United runs two similar programs in parallel – MPX and MP Dining.

In the latter, you register your credit cards with United, and any time one of them is used at a participating restaurant you automatically get miles – no need to generate gift cards as an intermediary step.

Good morning

I have been on the United plus X for a couple of years. This morning I purchased a $500card for Lowes, a local big box lumber yard. The gift card showed up, received my notice from AMEX it went through and no dollars on the card. I can find no phone numbers to call. And only a email contact. I used the email contact before and never heard back. Any recommendations????