CS100 Flight Test Vehicle 1 (FTV1) during fuel flow testing.

Photo: Bombardier Aerospace

Here’s what’s been going on with the Bombardier CSseries over the past few weeks:

- Bombardier announced that their team had completed the CSeries Complete Airframe Static Testing (CAST) for Safety of Flight. This was the last of seven tests required for obtaining flight certification for the CS100 from Transport Canada. In step with the Static Testing, the CS100 ’œAircraft 0’ Integrated Systems Test Rig has been ’œflying’ since last August.

- On June 4, Moscow-based leasing company Ilyushin Finance Co (IFC), firmed up its order for 32 CS300s, along with options for 10 more CS300s. That brings the CSeries firm orders up to 177 aircraft.

- On the same day, it was revealed that Gulf Air is the previously undisclosed customer for 10 CS100s that have been part of the firm order book since June 2011. Gulf Air also holds options for 6 additional CS100s.

- Bombardier’s President, Pierre Beaudoin, has said that they’re on schedule for the first flight of the CS100 by the end of June. There’s been speculation that the first flight would happen before the Paris Air Show, which starts June 17th. But Chet Fuller, Bombardier’s Senior Commercial VP dismissed the rumors. However, Flight Test Vehicle 1 (FTV1) was moved to Bombardier’s flight test centre last week.

- And following up on our earlier story about Porter Airlines’ order for CS100s, Toronto City Council recently voted to hire independent consultants to analyze the Porter proposal. Porter’s order for 12 CS100s is conditional on getting a 500 foot extension built on each end of the main runway at Billy Bishop Toronto City Airport (YTZ). Some results of the study will be reported to Toronto’s Executive Council in early July, with the issue expected to return to full council in November.

What do you think? Will FTV1 not fly until June 30th? Or will they try for the first flight while the Paris Air Show is on? If so, I’m thinking it would be great PR, and support for their marketing efforts at the show.

|

This story written by… Howard Slutsken, Correspondent. Howard has been an AvGeek since he was a kid, watching TCA Super Connies, Viscounts and early jets at Montreal’s Dorval Airport. He’s a pilot who loves to fly gliders and pretty well anything else with wings. Howard is based in Vancouver, BC.

@HowardSlutsken |

The new Bombardier CSeries in Montreal. Photo by Chris Sloan / Airchive.com.

This story was written by Chris Sloan, who operates Airchive.com and is the creator/producer of the TV show Airport 24/7: Miami seen on the Travel Channel. This is a two part story. Read PART 1 here.

In spite of lining up the required financing and support from the governments of Canada, its home Province of Quebec, and the UK, Bombardier put the CSeries program on hold on January 31, 2006 after failing to secure enough orders to move ahead. Bombardier’s attention shifted to the CRJ1000. Just a year later on January 31, 2007, Bombardier restarted work on the CSeries.

BONUS: Taking an ERJ to Mexico on Continental, when the airline still existed

The aforementioned specifications and dimensions were locked in and the real development and marketing began. Late that year, Bombardier announced that an entirely new engine ’“ the Pratt and Whitney PurePower Geared Turbofan would be the exclusive power plant for the plane.

On February 22, 2008 the CSeries was officially made available for marketing to airline customers. Even amidst a deteriorating economic backdrop but perhaps spurred on by the sharply spiking fuel prices, Bombardier announced the official launch of the CSeries on July 13, 2007 at the Farnborough Air Show.

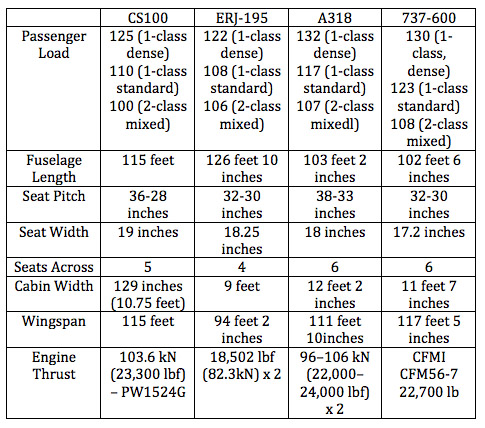

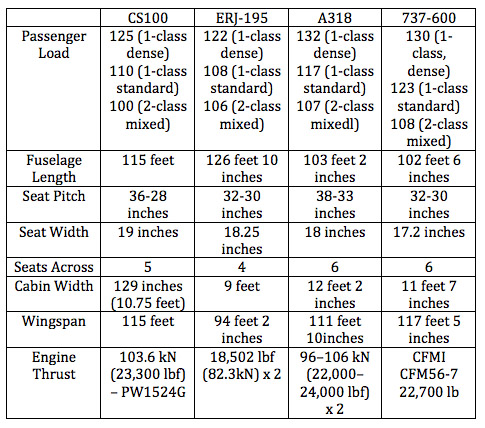

Chart by Chris Sloan / Airchive.com showing the CS100’s competition.

The key details announced were that launch customer, Lufthansa, had ordered 60 aircraft (including 30 options) for its Swiss European subsidiary. Bombardier also announced that final assembly would be an new line alongside the CRJ700/900/1000 line at Montreal’s Mirabel Airport. Additional major components, in particular the composite based wings and certain fuselage sections, would be built at the Bombardier factory in Belfast, Northern Ireland. The forward and some fuselage sections, as well as the cockpit, were supplied by Bombardier’s St-Laurent facility.

The CSeries program has several major suppliers including Shenyang Aircraft of China who contributes the rear barrel, Italian 787 contractor Alenia supplies the horizontal and vertical stabilizers, Zodiac provides the seating, bins, and cabin furnishings; and Rockwell Collins supplies the avionics suite (more on this later). Like the 787, these vendors reportedly have some equity and risk-sharing stakes in the program.

In a major March 2009 announcement, the aircraft were officially rebranded the CSeries CS100 and CSeries CS300. The C110 name always seemed like it could be confused with the military freighter. The CS100 title echoes the baseline-seating configuration of 100 seats, but there’s no clear reason as to the significance of the CS300 branding or why CS200 was skipped over’¦for now. At the same time, airline-leasing company Lease Corporation International unusually became the launch customer of the larger CS300, ordering 17 of these in addition to 3 of the smaller CS100s.

Over the next 5 years, orders from 13 customers totaling 66 for the CS100 and 114 for the larger CS300 accrued for a total of 180 orders, hardly a ’œbarn burning number’ but enough to move forward with the program. Bombardier doesn’t confirm these numbers however saying they have orders and commitments for 382 CSeries. Given the harsh worldwide economic conditions of the last few years and this being unchartered territory for Bombardier, the number is respectable but needs to grow quickly to come anywhere near Bombardier’s targets.

Computer mock ups of the CS100 and CS300 from Bombardier.

Even though sales haven’t set the world on fire, Bombardier conceives the CSeries not as a niche aircraft. Bridging the RJ and 737/A320 gap in the 100-149 passenger range, they forecast the market to be over 19,000 aircraft and $250 billion in revenue over the next 20 years. Further, they very optimistically expect to capture up to half of this market with the CSeries, identifying the aircraft as the future of the company.

The proof will be in the pudding, and the pudding is definitely a new recipe in the class with major technical advancements. In today’s high fuel price environment and razor-thin profit margins, fuel burn and operating costs are the leading consideration. Bombardier claims a 15% cash operating costs advantage and 20% fuel burn advantage over the E-Jets and other competition. Further, they claim a 25% direct maintenance cost savings. Environmental benefits run a close second. Bombardier promises the CSeries produces 50% fewer NOx emissions relative to its competition and has a 4 times quieter noise footprint.

Bombardier achieves these gains via 70% of the airframe being constructed of advanced materials such as composites and carbon-fiber (though not to the extent of the 787 or A350XWB) and the next generation engines. These technologies allow for greatly reduced weight and maintenance. The manufacturer claims the CSeries aircraft will be up to 12,000 lbs lighter than other aircraft in the same seat category. Importantly, the CSeries doesn’t rely on the extensive electrical architecture as the 787 and uses traditional Nickel-Cadmium batteries as opposed to the problem plagued lithium-ion batteries that have bedeviled the Dreamliner.

The spacious and very visible flight deck is also advanced, and in fact features Bombardier’s first use of sidestick three-axis full fly-by-wire controls and a new auto-throttle system. The Rockwell Collins Avionics Suite features the now compulsory large LCD displays, dual FMS (Flight Management System) with optimized control and display functions, dual CCD (Cursor Control System), datalink, sensed electronic checklist, and Cat llla autoland abilities. Optional features include single or dual EFB (Electronic Flight Bag), Cat lllb autoland capability and HUD (Single/ Dual Head Up Display) to optimize flight preparation, operation and mission completion. Key to efficiency in this category is the new RNP0.1 technology that allows the CSeries precise fly routes, continuous descent, optimized missions and approaches, and reduced emissions and noises. In another spark of ergonomic innovation, the radio panel is integrated into the glareshield.

Like the 787 and upcoming Airbus A350XWB, the CSeries boasts cabin enhancement features most of which are entirely new to its class: larger windows, dynamic LED ’œmood-lighting’, and upsized overhead binds offering 20-25% more volume than its narrow-body competition. With most of the fuselage not being of composite construction and most routes being short-to-mid haul, lowered altitude cabin pressurization ala the Boeing 787 Dreamliner wasn’t included in the feature list. At 41,000 feet, the CSeries’ cabin is pressurized at 8,000 feet.

During the CSeries unveiling ceremony in Montreal. Photo by Chris Sloan / Airchive.com.

The rollout, billed as a Program Update, was held at Bombardier’s Montreal Mirabel manufacturing facility where all the company’s commercial airline production operations are now concentrated. The packed house of 200 journalists, analysts, customers, and VIPs were joined by an event simultaneously taking place at Bombardier’s wing manufacturing facility in Belfast, Northern Ireland. Video packages from major suppliers around the world were also part of the mix.

Mike Arcamone, President Bombardier Commercial Aircraft presided over much of these announcements in a clearly excited, but well-paced, emcee fashion. With dramatic lighting and slide presentations in French and English, this being Quebec after all, the program began with a number of product updates to be shared.

In the first of the morning’s big announcements, Bombardier confirmed the rumored launch (first reported in November, 2012 by Flight Global) of its new 160 seat extra capacity option. This option, available in all CSeries CS300 models will be achieved by reducing seat pitch to 28’ using Zodiac slim-line seats and adding an extra set of emergency exits over the doors. This option ups the original maximum capacity of 135-45 seats. Air Baltic of Latvia will be the first of the three launch customers of this option, but will operate their aircraft with 148 seats. With the extra capacity option, Bombardier claims an 8% increase in seat economics over the baseline CS300.

The program timeline indicates all the aforementioned dates remain on track, with the CS100 still expected to take its first flight by June 30, 2013 and the flight-testing program to begin shortly thereafter. EIS will be mid-2014. The CS300 first flight and EIS is still in the 2014/2015 timeframe respectively.

The windows are quite larger on the new Cseries, providing more natural light and shoulder room. Photo by David Parker Brown / AirlineReporter.com.

On the manufacturing side, Bombardier confirmed that after the first few test and production aircraft are built in a temporary line at Mirablel, the new pulsing, moving final assembly line opening in 2014 would be capable of producing up to 100 CSeries per year. They didn’t disclose the date they would reach this level however. Bombardier has had lots of experience with out-sourcing and with the simpler structure, this does seem like a realistic goal.

After all the briefings concluded, the crescendo arrived. With the theatrics of a Las Vegas show, the projection screen lifted to reveal FTV-1, the first CSeries. Bathed in a dramatic dark blue light, de-emphasizing its unpainted ’œgreen’ state and flanked by proud Bombardier employees, the aircraft received a standing ovation for its first performance. Some may argue the program’s long-term prospects but even in this un-finished state (with missing fairings), everyone agreed the aggressively sculpted aircraft looked beautiful, and was practically begging to fly.

Of course, it was a bit of a surprise that Bombardier didn’t paint their first aircraft in a flashy livery as others have done, and it is unknown whether to what extent it will be painted for the first flight. To their credit of not hiding anything, Bombardier did raise the house lights so the audience could see the detail of the still impressive unfinished aircraft. Almost instantly following the event, workers surrounded the aircraft and resumed their round the clock 3-shift schedule to get the aircraft airworthy.

Everyone expected the CSeries to be rolled out but what they didn’t expect was that Bombardier had a big surprise up their sleeve! Minutes after the unveiling of the CS100, they dropped another curtain to reveal 3 more flight test aircraft in some cases advanced forms of build: FTV-1, 2, and 3. This unexpected moment drew another round of cacophonous applause. Bombardier will have 7 FTV’s ’œFlight Test Vehicles’ (a ’œNASA’ way of saying ’œaircraft’) in their flight testing program: 5 CS100s and 2 CS300s. FTV-1 will be used more for aerodynamic flight dynamics tests while FTV-2 will be heavily focused on avionics. CS100 FTV-5 will be the first with the passenger cabin.

The ultra-efficient, high bypass Pratt and Whitney PurePower 1500 Geared Turbofan generates up to 23,000 pounds of thrust while reducing fuel burn 20-25% and decreasing the noise footprint by up to 4X. Photo by Chris Sloan / AirlineReporter.com.

Virtually all recent commercial aircraft programs timelines have slipped and the CSeries is no exception. Though certainly its much less complicated supply and manufacturing chain has thus far led to much fewer and shorter delays then the admittedly much larger and more technologically demanding Airbus A380 and Boeing 787. The first flight of the C100 was originally confirmed for the second half of 2012 and then December 2012. Deliveries were confirmed to begin by the end of 2013. With roll out on March 7, 2013 the first flight date has obviously slipped but is pegged to be no later than June 30th. If the 12-month flight test and certification program remains on schedule, deliveries will commence in mid-to-late 2014. The C300s timeline is about a year later with first flight in 2014 and deliveries commencing in 2015.

A big question is how competitors A, B, & E will respond once the aircraft enters service. In response to the CSeries, Embraer considered the idea of a fresh design, but as Bombardier did with its CRJ700/900/1000 series instead chose the conservative route. They announced they would counter the CSeries with updated 2nd generation versions of their E-Jets, further amortizing the costs of the platform.

The new E-Jets, announced in 2011, would feature a slightly stretched fuselage, a new composite based wing, and taller landing gear to accommodate a much more fuel-efficient Pratt & Whitney geared turbofan engine, similar to that of the C-Series. According to ’œFlight Global’, Embraer has said the next generation E-Jets tentatively titled the 198, should appear between 2016-2018 but these haven’t been confirmed.

With Boeing and Airbus both choosing to go with their next generation 737 Max and A320 Neo versions of their cash cow aircraft instead of fresh designs, Bombardier looks to have the technological edge in the lower capacity portion of this market at least until the middle of the 2020s. Claiming 20-25% increases in fuel efficiency without resorting to more vanguard technologies that they claim is more apparent in the long haul and could threaten their current cash cows, Boeing and Airbus bowed to their shareholders and airlines who wanted a quicker solution and also chose the conservative route.

The ultra-modern CSeries flight deck features the Rockwell Collins Pro Line Fusion avionics suite with optional Electronic Flight Bags (EFB’s) and Heads-up displays (HUD’s). Image from Bombardier.

Not to be overlooked, the 2000s have not been kind to smooth manufacturing, testing, deliveries, on-time entries into service, and in-flight reliability of any of these game-changing aircraft, to wit the Airbus A380 and Boeing 787 Dreamliner. How smoothly the manufacturing ramp up is (Bombardier projects first year production will be 20-30 aircraft, and up to 120 a year by 3 1/2 years) how quickly the CSeries begins its deliveries (mid 2014), and perhaps most importantly how reliable it is once it enters service (Bombardier is promising s 99% dispatch reliability at EIS) will determine whether this aircraft is not only a game changer for Bombardier but for the entire industry.

Bombardier has changed the game before, however, and the industry knows better then to bet against them. Responding to a particularly pointed question from ’œThe Wall Street Journal’s’ Jon Ostrower about Bombardier taking on the Airbus and Boeing duopoly, BCA President Mike Arcamone in a not thinly veiled reference to the upcoming Max and Neo, said ’œThis is a real airplane not a paper airplane. This is not a re-engined aircraft but a new aircraft with a proven mix of new and proven technology. We will be there and we will win.”

GET MORE BOMBARDIER CSERIES STUFF:

|

This story written by…Chris Sloan, Correspondent.

Chris has been an airline enthusiast, or #AvGeek, since he was 5 years old. Over the years, he has amassed an extensive collection of aviation memorabilia and photos that he shares on his site, Airchive.com. He is the President and Founder of the TV production and promotion company, 2CMedia.com and Executive Producer and Creator of ’œAirport 24/7’ Travel Channel series.

@Airchive | Airchive.com | Facebook |

Change is here. Bombardier unveils their new CSeries in Montreal. Photo by Chris Sloan / Airchive.com.

This story was written by Chris Sloan, who operates Airchive.com and is the creator/producer of the TV show Airport 24/7: Miami seen on the Travel Channel (see AirlineReporter.com’s review of the show). This is a two part story, with PART 2 posting tomorrow.

On Thursday March 7, 2013 Bombardier introduced to the world what it and its customers believe is a game changing line of aircraft, the Bombardier CSeries. This ultra fuel efficient, partial-composite / advanced aluminum construction, ducted turbofan line of aircraft, with advanced 787 Dreamliner like cabin and passenger experience features is the first ’œclean sheet design’ regional / short-to-medium haul category in a decade. Even more significantly, it attempts to create a new successful class of aircraft that could one day rival the duopoly of the Boeing 737 and Airbus A320 families.

Bombardier is not new to game changing aircraft. 20 years ago, Bombardier Aerospace first changed the game, and indeed created a new category of airliners – the first modern 50 seat ’œRegional Jet’, with the CRJ100/200 series. With the first entry into service of the Canadair Regional Jet CRJ100 and CRJ200 in 1992 and 1996 respectively, Bombardier’s RJs became a phenomenal success for both the manufacturer and their airline customers. Indeed by the time production concluded in 2006, a total of 938 examples of both types were in operation.

BONUS: Flying on a CRJ-900 for 23min to Tucson

In the low fuel price environment and economic high gear era of the 1990s, the CRJs became much sought after by passengers and airlines as replacements for turbo-prop equipment such as the ATR series and ironically, Bombardier’s Dash 8, which would both later undergo a renaissance. In spite of their fairly high cost-per-passenger mile, The CRJs opened up new city pairs, new levels of comfort and smoothness (compared to the turboprops), bought jet service to smaller markets, and took regional airlines such as American eagle, SkyWest, and ASA to new heights. The CRJ’s success spawned their chief Brazilian competitor, Embraer to launch their own competitors in the 37-50 seat category in the form of the ERJ 135/145, launching service in late 1996.

The small regional jet party came to an end in the 2000s as 2 recessions, post 9/11 air traffic collapse, deteriorating airline balance sheets, and most of all sharply escalating fuel prices particularly in 2008 sealed its fate. To put things in perspective, a gallon of jet fuel cost bottomed out a $.30 USD in January, 1999; peaked at $3.89 per gallon in July, 2008; and stands at $3.09 in January 2013. Even adjusted for inflation, this is 7.5X increase. Airlines began to not only reduce flying the first generation 35-50 seat regional jets, but wrote their values down to zero in many cases. They are being grounded en mass. Their former passenger fans have abandoned them, especially in the face of newer larger RJs and the fact that airlines used their RJs on some very long stages as they replaced mainline operations.

The Delta Connection brand through its subsidiaries and partners such as ASA, the former ComAir, and SkyWest, is one of the world’s largest CRJ operators. The CRJ200s are being retired quickly and have now been limited to routes of less then 2 hours in duration or 700 miles. This CRJ-200 is seen at the airline’s home base and hub at Atlanta. Image from Chris Sloan / Airchive.com.

As proof of this trend, according to ’œThe Wall Street Journal’ Delta has limited the 50-seaters to trips of a maximum of 2 hours or 700 miles. The few airlines that created branded services based on these expensive to operate regional airliners such as ACA’s Independence Air and ExpressJet’s self-branded service learned the hard way that these small RJs couldn’t compete on a cost-per-passenger basis and they folded their wings. Ironically, the aircraft the smaller RJs replaced such as the Dash 8, Q400, ATR-42, and ATR-72 in turn replaced the RJs.

One study calculated that the use of a 50-seat Regional Jet would break even at 45 (out of 50) passenger seats compared to the Q400’s 35’“36 seats (around 55% breakeven load factor). Most short-haul routes are less than 350 miles, so the time spent on taxiing, takeoff and landing overrides an RJ’s speed advantage. As the Bombardier Q400’s 414 mph cruise speed approaches jet speeds, short-haul airlines can usually replace a regional jet with a Q400 without changing their gate-to-gate schedules. Such was the case as even long-time successful Alaska Air subsidiary Horizon Air was forced to convert its all RJ fleet to an all Q400 fleet. Alternately, some airlines such as Delta upgraded their smaller CRJs to Boeing 717s purchased from Southwest, following the AirTran merger.

DOUBLE BONUS: Flying a Frontier Airlines Bombardier Q400 into Aspen and a Q400 with Porter Airways

Back to happier times when they were flush with cash, healthy backlogs, ambition, demands from airlines for additional capacity, and perhaps even some clairvoyance as noted above, Bombardier and Embraer set their sights on larger designs. This foresight turned out to be correct as the market in the larger category of RJs continues to be healthy even as the smaller RJs precipitously decline. In the last 10 years, passenger traffic on RJs (classified as planes from 30-90 seats) has more than tripled according to the Department of Transportation. RJs are logging longer flights now with some stages close to four hours and the flight distance growing by 50%. According to a recent article in ’œThe Wall Street Journal’, ’œRegional airlines fly 64% of the takeoffs and landings at Chicago’s O’Hare International, 74% at Seattle-Tacoma and 52% at New York’s LaGuardia Airport. Still, the 50-seat jet, which is less fuel-efficient per-seat than bigger regional jets, remains the backbone of regional airline service and 43% of the entire regional airline fleet.’

A CRJ1000NG on the factory floor in Montreal waiting to be delivered to CRJ1000 Garuda Indonesia. Photo by Chris Sloan / Airchive.com.

Bombardier was first to explore the possibility of larger RJs, first considered purchasing the struggling Dutch manufacturer Fokker to gain access to the F-100 line. Then they looked at the BRJX, ’œBombardier Regional Jet eXpansion’ with a similar configuration to the CSeries with 2-3 seating and under-wing engines. Instead Bombardier opted for the conservative route: choosing to stretch, re-engine, and re-wing the CRJ200 into the CRJ700/900 line with maximum seating of 78 and 90 seats respectively. The CRJ700 entered service in 2001 with Brit Air while the CRJ900 entered service in 2003 with Mesa Air. In December 2010 Bombardier began delivering the 90-104 passengers stretched CRJ1000 to launch customers Nostrum and Brit Air.

With over 730 deliveries and orders as of December, 2012 the CRJ 700/900/1000 series is an unqualified success. Not one to be complacent and in response to the E-Jets, Bombardier launched an enhanced CRJ700/900 NextGen series in 2008. The stretch CRJs are capable of being fitted with First Class cabins and Wi-Fi and are a substantial improvement over the initial CRJ100/200s in efficiency and comfort, though the narrow 2-2 cross section remains unchanged. Indeed, this line has been the cash cow for Bombardier Aerospace, taking over for the CRJ200.

BONUS: Flying a United CRJ-700 from Seattle to LAX

Embraer chose to answer with an entirely new design: the E-Jets whose success would eventually spur the CSeries. The E-170 was built to compete with the CRJ700 and the E-175 was built to compete with the CRJ-900. They featured under-wing engines and wider fuselage then their competition. The E-170/175 first entered service respectively in 2004 with LOT and 2005 with Air Canada. With this success under its belt, Embraer leaped frog Bombardier with the stretched, new-winged, and larger engine E-190 and E-195, in essence creating a new class of aircraft. The E-190 and E-195 featured seating up to 114 and 122 passengers respectively. Jet Blue took delivery of its first E-190 in 2004 while FlyBe began the E-195 operations shortly after.

An Air Canada E-190 seen in Montreal. Photo by David Parker Brown / AirlineReporter.com.

The E-190, in particular, has emerged as the most popular of the E-Jets. The upsized E-Jets upstaged their secondary downsized competitors the Airbus A318, Boeing 737-600, and Boeing 717 (MD-95). These aircraft weren’t very successful and have basically been discontinued. Combined, the E-Jets as of December 2012 have 908 deliveries and 1093 firm orders with the bulk of the market concentrated in the larger E-190/195s. Clearly Embraer had the edge and near monopoly, particularly in the larger class RJs. With momentum shifting to its formidable competitor to the South, Bombardier needed to not only respond, but had to respond big with a game changing design.

DOUBLE BONUS: Review Flying a JetBlue Embraer E-190 and an Air Canada E-190 in Executive Class

Bombardier initially announced the CSeries (then known as the C110 and C130) in March 2005. The new CSeries would be the first RJ to access the next vanguard of aviation technology such as a high percentage of composites and new lightweight lithium aluminum for its wings and fuselage, and very fuel-efficient high-bypass geared turbofan engines under the wing. Looking closer, the majority of the fuselage would be constructed out of a new lighter weight lithium aluminum. The empennage, tail-cone, wing, and horizontal/vertical stabilizers would be constructed of composites.

Bombardier didn’t feel the additional lighter weight full composite fuselage would justify the additional production challenges and costs, especially on a shorter-range jet. In retrospect, this seems like a smart decision. The smaller C110, with up to 125 seats, would compete directly with the E-195, and secondarily with the Boeing 737-600, Airbus A318, and Boeing 717. The C110’s 125 maximum passenger capacity would be comparable to the E-195’s 122 max passenger capacity.

The mock up for the Cseries had different seat pitch for each row and you can see that some have fake entertainment screens as well. Photo by David Parker Brown / AirlineReporter.com.

The CSeries would have a wider 5 abreast cabin width of 10.75 feet compared to 9 feet wide and 4 abreast seating in economy in the E-195, allowing the CSeries to have wider seats and/or aisles. In terms of passenger appeal 80% of seats would be on an aisle or window, but the middle seats would have the potential to be larger and/or have larger arm rests. It would feature larger windows then any other airliner except the 787 Dreamliner measuring 11 X 16 inches. The C110 maximum seating capacity would be slightly less then the A318’s 132 passengers and 737-600s 130 passengers. However, the C110 would be 12 and 13 feet longer respectively then the A318 and 737-600 respectively. The CSeries’ 5 abreast cabin, seating in economy and 10.75 cabin width, would be quite a bit narrower then the 737’s 6 abreast 11 feet, 7 inches cabin and the A318/319/320’s 6 abreast 12 feet, 2 inches cabin.

The 2nd variant, the C130, at 124 feet, 10 inches, would be 9 feet and 10 inches longer then the shorter 115 feet long, C110. The wingspan of both aircraft, however, would both be the same at 115 feet. The stretched C130, with initially up to 135-145 seats would compete with the Boeing 737-700’s 148 maximum seats and Airbus A319’s 142 maximum seats.

However, there hasn’t been significant new interest in aircraft of this size: the 737-700 MAX has no orders at press-time and the Airbus A319 NEO has just a handful due to improved economics with the larger aircraft moving forward. Thus, the CS300 isn’t yet a direct competitor to the A320 / 737 family just yet.

With the larger CSeries meeting and in many cases exceeding its competition, this clearly signaled Bombardier’s intentions to take on the big boys in Seattle and Toulouse, not to mention it’s arch-nemesis in Brazil. It is clearly viewed as a threat however. Airbus is rumored to be selling A320s at prices similar to the CSeries 300 to prevent the nascent Canadian aircraft from encroaching into its market.

Chris’ story on the Bombardier CSeries will conclude on AirlineReporter.com tomorrow.

GET MORE BOMBARDIER CSERIES STUFF:

|

This story written by…Chris Sloan, Correspondent.Chris has been an airline enthusiast, or #AvGeek, since he was 5 years old. Over the years, he has amassed an extensive collection of aviation memorabilia and photos that he shares on his site, Airchive.com. He is the President and Founder of the TV production and promotion company, 2CMedia.com and Executive Producer and Creator of ’œAirport 24/7’ Travel Channel series.

@Airchive | Airchive.com | Facebook |

Alaska Airlines Bombardier CRJ-700 (N215AG) operated by Skywest seen at SEA.Photo by Keith Draycott.

Not too long ago, Seattle-based Horizon Air flew CRJ-700s for the Alaska Air Group. Then, Horizon announced they would get rid of the CRJ-700s and only fly a fleet of Bombardier Q400s). Shortly thereafter, Alaska announced they would absorbthe Horizon brand. Now, Alaska Airlines has contracted out with Skywest to fly Bombardier CRJ-700 regional jets on some of their west coast routes.

The Alaska Air Group felt there was still a need for a 70-person regional jet to serve some of their west coast destinations, resulting in Alaska Airlines contracting with Skywest to fly 22 daily CRJ-700 flights between Seattle/Portland and Burbank, Fresno, Long Beach, Ontario and Santa Barbara.

Interesting enough, Skywest is leasing the CRJ-700s from Horizon Air and flying them for Alaska under the new brand. The regional jets will sport the Alaska Airlines livery with a smaller “Skywest” on the fuselage. The interior will have blue leather seating, to match what you might find on an Alaska Air Boeing 737. However, the service will mirror what you would expect from flying on Horizon Air (yay free beer and wine).

“Alaska’s goal is to create a consistent customer experience on all of its regional-aircraft flights and provide a level of service including beer and wine that will compete against other regional airlines that offer a first class cabin,” Marianne Lindsey, Alaska Airlines Corporate Communications explained to Airline Reporter. “Coffee, napkins, cups, the inflight magazine, flight attendant uniforms and flight attendant announcements will match Alaska’s. Boarding passes and a decal next to the aircraft boarding door will indicate the flights are being operated for Alaska by SkyWest.”

Horizon hopes to have a single fleet of Q400’s by June 1st, matching Alaska’s single fleet of Boeing 737s. It becomes more economical for Horizon to lease the aircraft through Skywest since they have many more CRJs in their fleet, allowing economies of scale that Horizon or Alaska cannot match.

Horizon Air employees are trained to work with the CRJ-700, but since they will now be operated by Skywest, there will be some operational changes that have required employees to go through some re-training. “More than 2,200 employees at Alaska, Horizon, SkyWest and our partner vendors have been trained,” Lindsey explained. “More than 40 computer systems have been integrated and more than 400 processes have been confirmed–all to ensure safety and compliance, as well as a seamless product for our customers.”

Alaska didn’t indicate that it immediate plans for additional routes to be flown by the CRJ-700s. “We’re continually evaluating demand in all Alaska markets and will ensure the aircraft type and frequency (or capacity) continue to match demand throughout the Alaska system,’ Lindsey confirmed.

I would imagine there could be some hiccups with so many changes happening at one time for the new Alaska, old Horizon and the addition of Skywest. However, Alaska has a good track record of keeping people informed and trying to make the changes unnoticeable to their customer. Although many of us airline geeks will notice a change of aircraft type and livery, most people just want to get from point A to B as safe and cheaply as possible.

Being a Seattle native, I have mixed feelings seeing the Horizon brand slowly going away. Alaska needs to be able to compete and keep themselves a strong independent airline. They have weathered many economic downturns without having to sell or merge. It is a love/hate relationship and it helps that Alaska Air’s livery looks so darn good on the Bombardier Q400 and CRJ-700.

Things of interest:

* Schedule of the Skywest CRJ-700s

* Photo of CRJ-700 in Horizon livery (N601QX which is now N215AG)

* An ex-Horizon CRJ-700 caught in Atlanta (N604QX)

* Photo of Alaska livery on CRJ-700 in flight (N215AG)

* Another photos of CRJ in AS livery on the ground (N215AG)

Image by Keith Draycott via Flickr

US Airways Express (PSA) CRJ 200 on the taxiway followed by ’œCompany Traffic’ CRJ 700

When passion, creativity, photography and the ability to write combine with fans, I love to share their work. This is a blog written by Andrew Vane for Airline Reporter taking a close look at Bombardier’s CRJs:

Canadian company Bombardier Aerospace acquired government-owned Canadair Ltd and entered the regional jet market in the 1980’s. Today the most commonly seen and flown CRJ’s consist of the CRJ-200 (50 seats), CRJ 700 (75 seats) and CRJ900 (90 seats). CRJ’s are most popular amongst the major airline’s subsidiaries for shorter domestic flights between hubs and along spokes. Here in Charlotte (KCLT), virtually all of Terminal E is occupied by gates to serve regional jets and turboprops. Similarly, in Cincinnati/Northern Kentucky Airport (KCVG), Delta dedicated a major portion of the largest terminal to their regional jet carrier Comair.

No this ain’t headed for New Orleans. It’s an Air Canada Jazz CRJ 200 bound for the Great White North.

The CRJ 200 is an upgrade to its -100 predecessor with the addition of more efficient engines coming in Extended Range (ER) and Long Range (LR) versions. Guess which one is longer? Answer: Without consulting Bombardier’s data, your guess is as good as mine. (Per the web site the range of the ER is about 1,800 miles and the LR version is 2,300 miles.) CRJ 100/200’s are most common domestically among the major airliner’s regional carriers Comair, Skywest, ASA, Air Canada, MESA, US Airways Express (PSA), Skywest and Republic.

First entering service in 2001, the CRJ 700 series provided a bit more seats and comparable range to the LR version of the CRJ 200. In profile, the easiest way to tell the difference between a -200 and -700 is the fact that the -700 is longer and the rear end is sticking up in the air. In addition to more seating, the CRJ700 features a new wing with leading edge slats and a stretched and slightly widened fuselage, with a lowered floor. CRJ 700’s are most frequently flown in the US by Air Canada Jazz, American Eagle, ASA, Comair, Horizon Air, Mesa, Skywest, and US Airways Express (PSA). A further refinement of the CRJ 700 was the CRJ 705 series, operated by Air Canada, which added 75 seats and split the aircraft into business and economy classes of 10 and 65 seats, respectively. Only sixteen 705’s were built.

ASA ’œAcey’ CRJ 700 rolling on 18C at Charlotte-Douglas International Airport.

Eventually, this French Canadian company, who also produces the popular Dash-8 family of turboprops, expanded the CRJ fleet design to include a longer -900 version. The CRJ 900 features a ’œcomplete re-design of all of the structure and systems. In addition, an all-new wing was developed that increases the cruise speed of these aircraft while offering excellent airfield characteristics. These aircraft also feature an all new interior cabin that offers increased room for the passenger, enabled by a lowering the floor by 1’ (2.54 cm) and redesigning the aircraft frame RJ900 that featured as of the original CRJ200, offering more headroom and a wider cabin. The seating and bins were completely redesigned to allow more passenger space and increased bin stowage,’ says Bombardier’s web site. CRJ 900’s are currently operated by Mesa Air, Air Canada Jazz, Skywest, Comair and Pinnacle Airlines.

From my own personal experience, I was a bit disappointed with the window placing and height for my 6-foot tall frame. I ended up with a neck ache each time I sat by a window. The windows are much lower compared to Bombardier’s Brazilian competitor, Embraer.

Some airlines have planned a future full of regional jets in lieu of larger aircraft with empty seats. Smaller aircraft lower to the ground provide easier boarding in variable conditions (jetway or stairs). With over 700 CRJ’s of all versions delivered by Bombardier in the last 30 years, chances are you’ll be riding in one of these the next time you fly out of a small city.

Bombardier’s CRJ story here.

Images: All photos by Andrew Vane