Boeing is one of the largest exporters of anything in the U.S. in terms of dollar value – Photo: Bernie Leighton | AirlineReporter

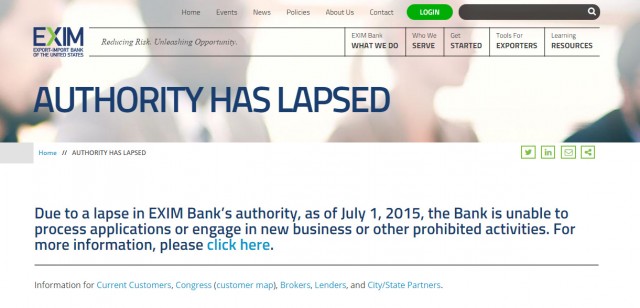

Before their summer recess, the U.S. Congress didn’t get many things finished; some would say intentionally. Most crucial for those of us in the aviation realm is the “sunsetting” of the U.S. Export-Import Bank. What is this bank, exactly? Well, it’s almost more of an underwriter.

Founded in 1934 by executive order, but affirmed into its own agency by law in 1945, the Export-Import Bank of the United States exists to offer insurance, loan guarantees, and other financial products to foreign customers. Why? Well, the goal of the bank is to provide American jobs and revenue to American companies while selling the goods abroad.

Who is America’s largest exporter in terms of real dollar value? Boeing!

What does Boeing do? Well, you are reading this site – you probably have an idea. Boeing, especially Boeing Commercial Aircraft, depends on the Export-Import bank to offer competitive financing rates to international customers. Or, if financing rates have already been obtained externally, offering an extra back stop for customers that do not have a long history of highly-rated credit.

The Ex-Im bank is not a lender of last resort – they are a paramount of financial virtue and do everything by the book. More importantly for those of us in America, they can sometimes offer better rates than the commercial markets in the name of continuing U.S. trade. Truly, to explain the Ex-Im bank’s importance would require a thesis-length article with lots of graphs. No one, but me, wants to read that. So let’s keep it simple, shall we?